Land registry title deeds can be tricky to understand. If you’re buying a property, or dealing with a property transaction, it’s important to understand the rights and responsibilities that come with the land.

That’s where Land Registry title deeds come in. Title deeds are a record of who owns the property and what rights and restrictions are attached to it. This information can be important when it comes to things like planning permission, building regulations and boundary disputes.

In addition, the title register can help to identify previous owners of the property, which can be helpful if you’re researching the history of your home. Understanding land registry title deeds can therefore be beneficial in a number of ways.

In this article we go through the HMLR title deeds step by step, and answer some of your frequently asked questions about Land Registry.

We also discuss our title deed insight solution that can help simplify the process of checking title documents.

House not registered with Land Registry? No problem, check out our guide to unregistered properties here.

Land registry title deeds are a legal document that proves an individual’s ownership of a property. The title register lists the owner’s name and address, as well as any restrictions or charges on the property, while the title plan shows the boundaries of the property.

Together, these documents provide evidence of ownership and can be used to resolve disputes over property boundaries or title. Anyone buying or selling a property, or involved in the transaction, should ensure that they obtain a copy of the deeds from the Land Registry or a trusted supplier like Veya.

The title register is a legal document that shows the ownership details of a property.

The title register includes important information such as a description of the property, the names of the current and previous owners, and any restrictions or easements that apply to the property.

When someone buys a property, they are required to register the purchase with the Land Registry. This ensures that the property’s ownership is accurately recorded and that any changes to the property’s title are made promptly and efficiently.

Title registers are public documents, so anyone can request a copy from the Land Registry. If you’re dealing with the sale of a property, it’s a good idea to request a copy of the title register in order to check for any potential problems that could affect it.

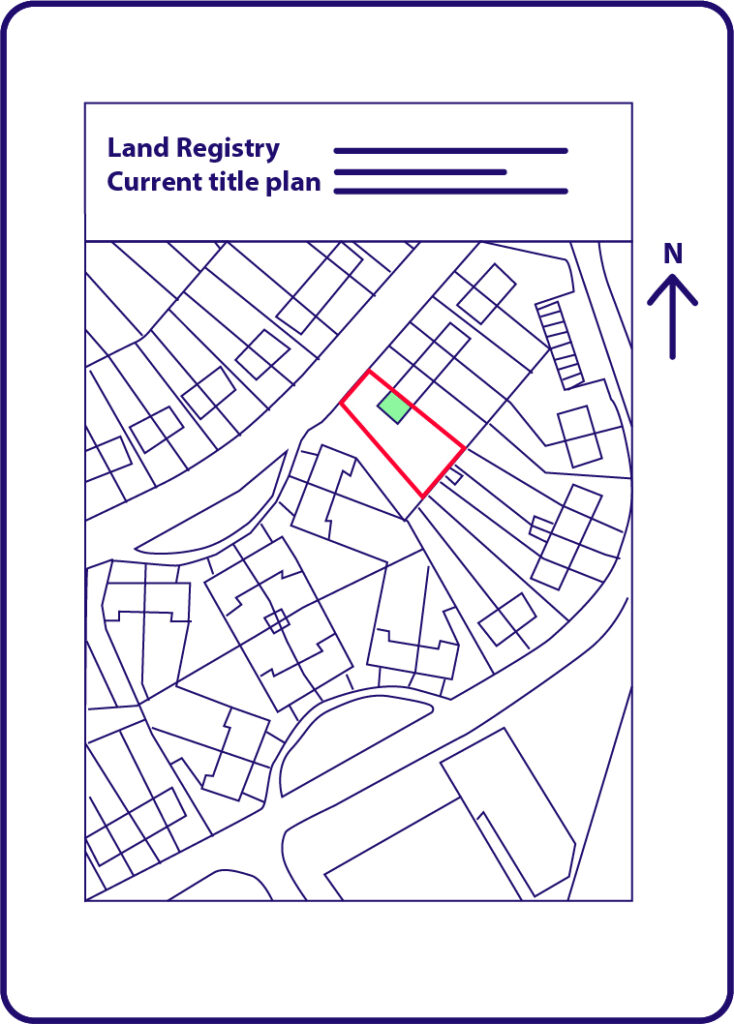

A title plan is a visual representation of the property’s legal boundaries, as described in the title register. The title plan shows a small area from the Ordnance Survey (OS) map, with black outlines indicating buildings, hedges and streets. The red line, known as ‘the extent’, indicates the registered property boundaries.

Land Registry title deeds provide a lot of useful information about a property, but they can be confusing to read if you’re not familiar with the jargon.

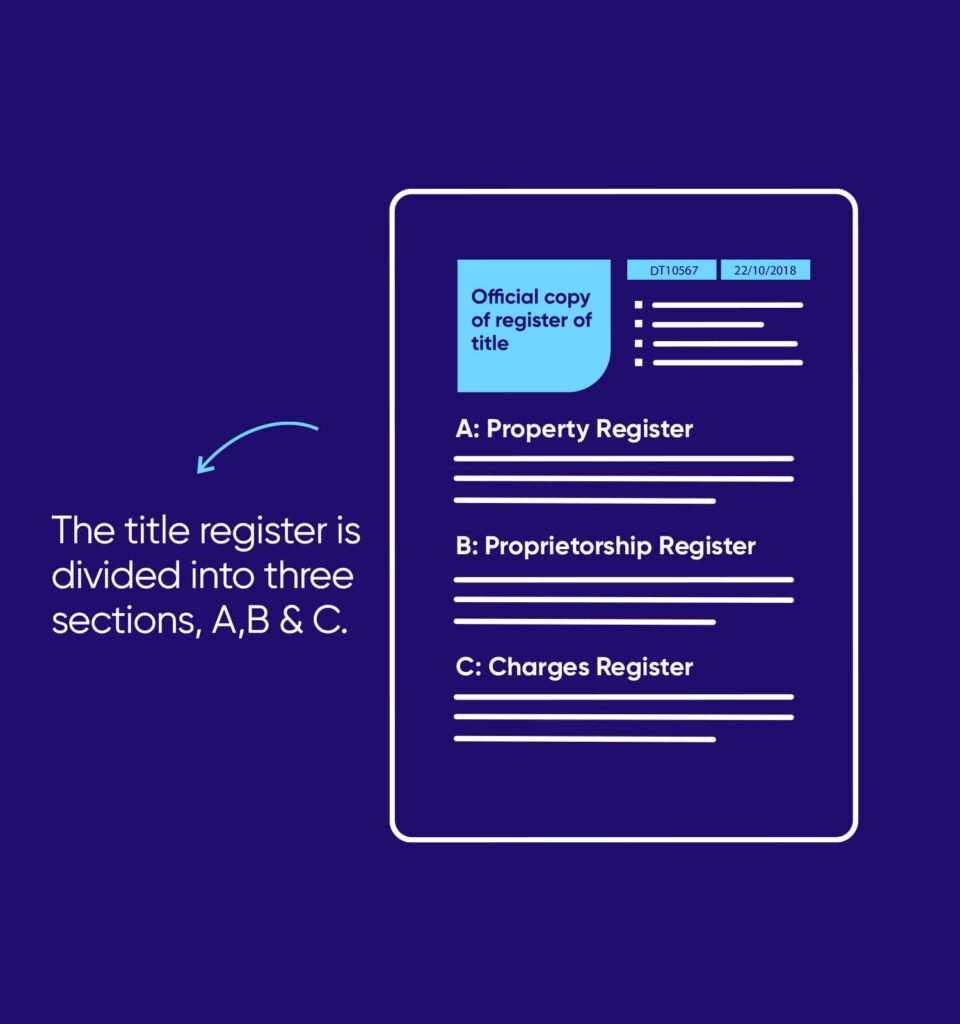

The title register is split into three sections. A – the property register, B- the proprietorship register and C – the charges register.

Here’s a quick guide to help you understand the most important details.

Section A of the title register is known as the ‘property register‘. The information on section A includes a description of the property and any rights that it may benefit from.

Here’s some information that you will find in Section A, and why it’s important to know and understand:

It is important for estate agents to read and understand the property and land description when selling a property as it helps them to answer any questions that potential buyers may have about the property. It also helps them to identify any potential problems that could arise during the sale, such as boundary disputes or restrictions on use.

Furthermore, understanding the property and land description can help estate agents to give accurate and up-to-date information about a property to potential buyers, which is essential for a successful sale.

It’s important to know how much time is left on the lease. The length of the lease will affect the value of the property and the buyer’s ability to get a mortgage. If the lease is short, it may have difficulty for the buyer to find a lender who’s willing to finance the purchase.

In addition, shorter leases generally carry lower values than longer leases. The length of the lease will likely be a critical factor for potential buyers, so it’s important to know this information upfront.

The proprietorship register is a key section of the Land Registry title deeds. It lists the names and addresses of the current owners of the property, as well as any mortgagees or other encumbrances on the property. This information is important for estate agents to understand, as it can help them to determine the value of a property and identify any potential risks associated with it.

In addition, the proprietorship register can provide valuable insights into a property’s history, which can be useful when negotiating sales or leases. For these reasons, it is essential for estate agents to read and understand section B of the Land Registry title register.

Here’s some information that you will find in Section B, and why it’s important to know and understand:

It is important for estate agents to know who the registered owner is for the property they are selling for a few reasons. The legal owner is the person who owns the property in the eyes of the law. This may be different from the person who actually lives in and uses the property.

For example, if a property is owned by a company, the legal owner would be the company, even if someone else lives in and uses the property. If an estate agent does not know who the legal owner is, they may not be able to sell the property.

Additionally, it is important to distinguish between privately and company owned properties. This distinction can affect how a property is taxed and how much legal protection the owner has.

Lastly, it’s important to know if there are any beneficial owners of the property. They may not be listed as the legal owner, but they may still have a say in what happens to the property. Knowing who the beneficial owners are can help an estate agent make sure that everyone involved in a sale agrees to it.

The term ‘title tenure’ refers to the legal right to occupy and use land for a specific period of time. Freehold means that you own the property outright and can live there for as long as you like. Leasehold means that you have the right to occupy the property for a set period of time, typically 99 years. At the end of the lease, the property reverts back to the freeholder.

It is important to know the title tenure of a property you’re dealing with as it affects the rights and responsibilities of the homeowner. For example, leaseholders may need to obtain permission from the freeholder before making certain alterations to your property.

Restrictions listed on section B of the register relate to any limitations on how the owner can use the property. For example, there might be a restriction on carrying out certain types of work, or on using the property for business purposes. It’s important to check for any restrictions on the use of the land to ensure you’re upfront with potential buyers.

The charges register is a section of the Land Registry title deeds that lists any charges or encumbrances on the property. This can include mortgages, rights of way, and covenants. It is important for estate agents to read and understand section C of the title register because it can affect the value of the property and the terms of any sale.

By understanding section C of the title register, estate agents can provide accurate and up-to-date information on the property, which will help to secure a successful sale.

Details on mortgages and other financial burdens will be listed on section C of the register. If there is a mortgage on the property, the estate agent will need to know how much is owed and whether the mortgage can be transferred to the new owner.

It’s important to understand what easements and covenants are, as they might affect the use of the land. An easement is a legal right to use someone else’s land for a specific purpose, such as passage or utilities.

A covenant is a promise or agreement to do (or not do) something. For example, a property owner might agree not to build anything taller than a certain height. Covenants are typically created when land is subdivided and can be enforceable by future owners.

Easements and covenants can impose some restrictions on what can be done with a property, so it’s important to be aware of them. If there are any rights of way or covenants, the estate agent will need to advise the buyer on these restrictions.

Land Registry is a government department that deals with property and land registration to record ownership. Having a property registered with Land Registry shows evidence of ownership, protects against the risks of fraud and makes selling the property simpler. The registry records change of ownership, as well as mortgage details or leases that may affect it.

Original title deeds are paper documents that are used to transfer the ownership of a house from one person to another. The deed includes information about the property, such as current and previous owners and its address. It also includes a description of the property, which can be useful if there is ever a dispute about its ownership.

Today, HM Land Registry is the definitive record of land and property ownership in England and Wales. If your property is registered, you will not need the original title deeds to sell your property.

Scanned copies of the original deeds are usually held by Land Registry, so if you can’t find your original paper documents and would like to see them you can do a property search on their website.

Check out our guide to unregistered properties if your house in unregistered and you would like to know more.

If the property owners can’t find the original title deeds, but they know that the property is registered, you can find the digital copies via the Land Registry online portal. If a property is unregistered, a little bit more legwork is required if the owners want to sell. Therefore, estate agents will need to work with the owners and a conveyancing solicitor to help obtain proof of ownership. The property can be registered for the first time by Land Registry.

In 1990 it became mandatory to register all land in England and Wales with Land Registry if it was being bought, sold, gifted or mortgaged. Therefore, some properties have not been registered as they have not yet triggered the requirement to register. That being said, it is wise to voluntarily register properties as it will reduce complications when deciding to sell and will reduce the risk of property fraud. First registration details can be found here.

Estate agents don’t have a legal obligation to check title deeds. However, one of the best ways an estate agent can meet industry best standards is to access the Land Registry title deeds for proof of ownership. These documents explicitly record proof of ownership. In addition, for proving ownership estate agents should also perform identity verification checks to ensure they are dealing with the genuine owner.

Title Deeds are documents that estate agents can use to their advantage when selling property. They provide valuable information about the title of an individual’s land, which could help resolve issues upfront and avoid any future delays in getting it sold or rented out quickly.

In addition, title deeds can help estate agents to stay compliant with Trading Standards. By reading and understanding property title deeds, agents can ensure that all of their marketing materials include accurate property details, and that no important information has been accidentally omitted.

The HM Land Registry portal is a UK government department where title deeds for properties In England and Wales are registered. They offer a business e-services platform where you can access title deeds online. You can use Land Registry by heading to the HMLR login page and registering for an account with an email address.

You will then be able to perform a property search and download the title plan and title register for any registered property in the HMLR portal. You can use the property search function to search land registry by title number or the property address.

You can use the HM Land Registry portal to:

You can set up alerts using the digital service on the Land Registry business e-services page so that you get updated about your documents.

Business e-services users

If you’re a business user, you can benefit from Land Registry’s Digital Registration Service making applications easier and faster. You can also make an application enquiry via the HMLR portal to review application details against a title.

You will need to go to the HMLR portal where you can search for any property in England and Wales by entering the house number/name and postcode to check title deeds. The Land Registry fees are £3 for the title plan and £3 for the title register. You will need to create an account with an email address and add billing information first to perform the Land Registry search. As it is public information, anyone is allowed to access HMLR title deeds.

In addition, once you have downloaded the title plan and register, you should then read the document in detail.

Although Land Registry documents are easily accessible, reviewing them in detail can be a long and arduous process. Many estate agents may simply skip this part altogether or miss pertinent information on the title deed that can slow down the sale.

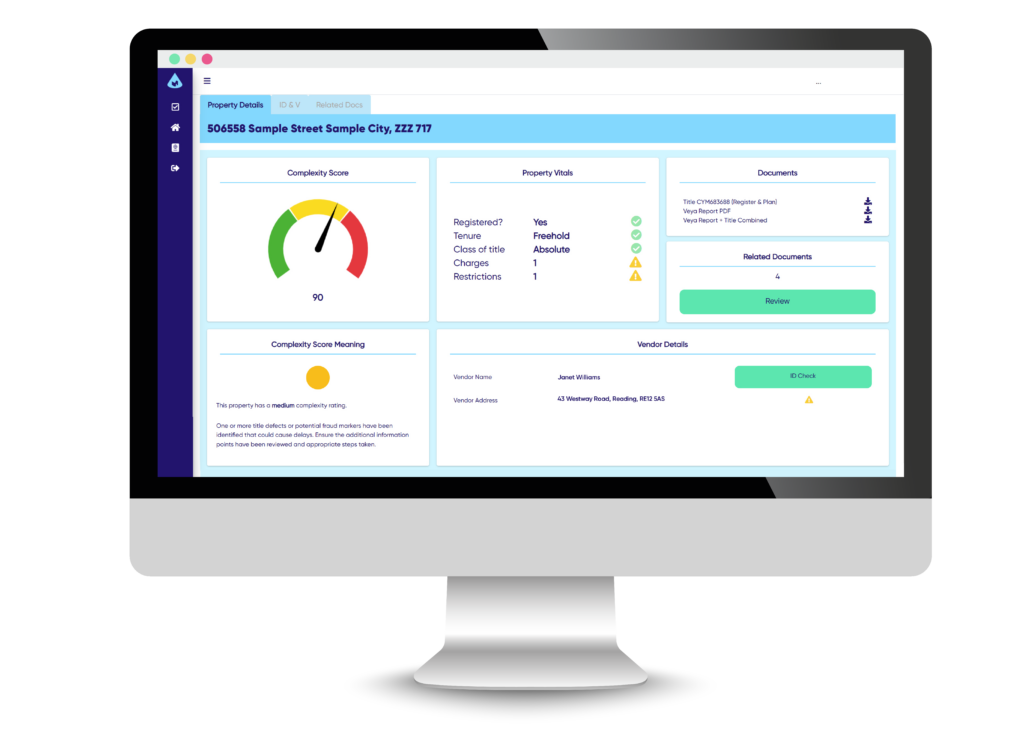

That’s where Veya steps in – a title deed insight tool that interfaces to the Land Registry. Veya analyses data on any property in seconds, providing a succinct property report instantly.

Veya provides a complexity score on the property, to give the estate agent an understanding straight away of how complex the property may be to sell. The Veya Report provides a set of recommended actions to help remedy this.

Veya’s fully integrated compliance software also automates identity verification and provides AML compliance and source of funds checks for estate agents. With HMRC’s regulation of agents concerning anti-money laundering increasing, Veya’s service means you can negotiate with confidence secure in the knowledge you are fully compliant with minimal costs.

By using Veya , estate agents can get sales over the line faster, reducing the average sales progression time by 25%. T h i s intelligence also helps position estate agents as experts in their field so they can delight potential clients with a wealth of information on their property. This means that agents using Veya can win more instructions and be in a better position to negotiate risk-related fees.

Understand how to review title deeds in detail to uncover important details about properties.

Key takeaways: